2025 marked the third consecutive year of double-digit returns for the S&P 500 Index. Domestic stocks were exceptionally volatile and kicked off the year with a 19.2% drop through April before rebounding by 37.4% through December (for a net annual gain of 16.4%). Sector-wise, technology reigned supreme, with the S&P 500 Technology and Communication Services Indexes (includes several AI-stocks) gaining 23.3% and 32.4%, respectively, while prominent mega-cap technology leaders for the year included Alphabet, NVIDIA, and Broadcom, which climbed over 40% apiece.

2026 will surely present new economic challenges and surprises, as every year does. We are forecasting both economic tailwinds and headwinds that will need to be monitored as they unfold. Below are six key factors we expect to drive the economy and markets in 2026:

Potential Headwind – Near-Record Equity Valuations

The prospect of a stock market bubble has long been on the minds of investors, and back-to-back years of stellar performance from the AI-centric “Magnificent 7” cohort of stocks has only amplified this concern. Last month’s commentary discussed valuations at length and came to rest on the fact that they are often poor timing tools, frequently leading market turning points by years. This time appears no different, and current valuations may even be justified by the blistering rate of earnings growth among stocks – especially among the Magnificent 7 mega-cap technology companies.

That said, there is always the risk that companies may not meet growth expectations or that technology firms won’t be able to recoup the high costs of investing in AI infrastructure (e.g. chips, data centers, and power generation). This risk can especially be problematic for companies financing their investments with debt, as using leverage amplifies the effect of both profits and losses.

When valuations are stretched, investors tend to be highly sensitive to bad news or anything that could potentially reduce earnings growth. Our base case is that companies will continue increasing their profits as they have in previous years, but there will always be a risk of an exogenous event or economic shock that could cause high-flying stocks to blink in the new year.

Tailwind – Reduced Tariff Uncertainty & Improving Business Sentiment

The first six months of Trump’s term in 2025 were dominated by trade policy, and namely the enactment of the highest tariffs in over 100 years. Many countries responded with their own retaliatory tariffs, and the tit-for-tat trade war brought the threat of a global surge in tariff-driven inflation to the forefront. Moreover, the day-to-day changes in trade policies made doing business difficult, leading to a general sense of pessimism and anxiety among business owners.

Business sentiment is an important driver of economic activity. When business leaders are optimistic about the future, they take on new projects and often expand their workforce. The opposite is true when they’re pessimistic or uncertain, opting to “play it safe” until sunnier skies prevail. Business pessimism spiked last spring but has gradually improved as tariff rhetoric softened. We expect de-escalation of trade tensions to continue through 2026, providing a much-needed green flag for businesses to reconsider plans to invest in and expand their operations. We also don’t consider the recent operation in Venezuela as impactful to business sentiment so long as other, larger nations aren’t intervening. In fact, based on recent stock performance, energy companies are viewing the operation as potentially good for future profits.

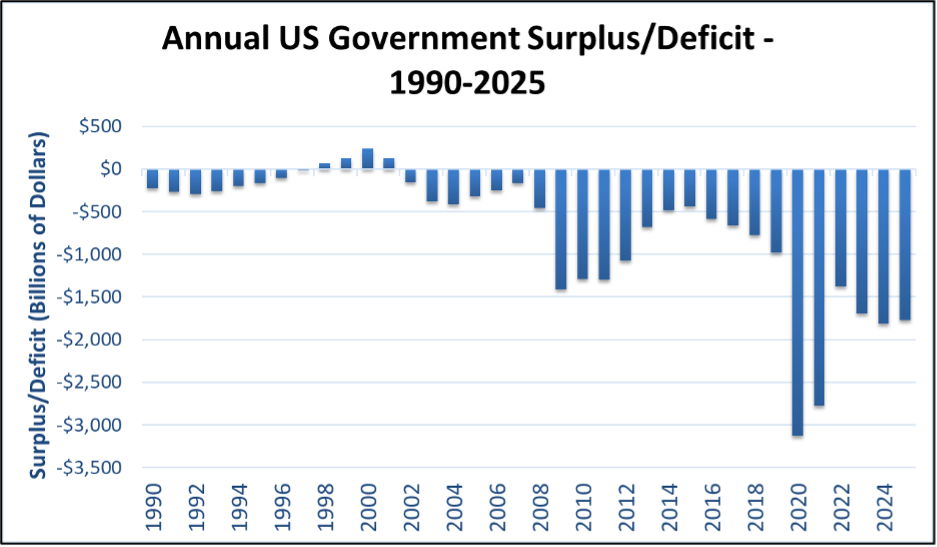

Tailwind (But a Long-Term Headwind) – More Deficit Spending & Ballooning National Debt

The 2020s have marked a new era for government spending – one in which more is seemingly never enough. Massive COVID-related stimulus programs, such as the CARES Act and American Rescue Plan, caused the federal debt to balloon from $23.2T at the beginning of 2020 to $29.6T by the end of 2021. Spending continued to surge post-pandemic and through the start of Trump’s second term, touching $36.2 trillion as of summer 2025. Large cost of living adjustments to Social Security and increased Medicare spending drove much of the increase, but a tripling of interest costs on federal debt from 2020 also tilted the scales. Trump’s One Big Beautiful Bill Act (OBBBA) is expected to further increase budget deficits by a $3.4 trillion through 2034, potentially sending the total US debt to over $50T by the mid-2030s.

Source: Office of Management and Budget

Deficit spending is stimulative, at least over the short term. Over the long run, the interest costs of running high deficits can hamper future investment and/or result in the need for higher taxes. There is also the risk of currency devaluation and capital flight when investors view a nation’s debt as unsustainable. The data suggests the US is not currently at that point, although bond investors are currently demanding increased compensation (i.e. higher yields) for lending the US government money beyond ten and twenty years.

So long as borrowing rates are contained, we view increased government spending as a tailwind to economic and stock market performance in 2026. A noteworthy boost to the economy should take place this spring when provisions of the OBBBA result in outsized tax refunds: especially for seniors, tipped/hourly employees, and itemizers from high-tax states.

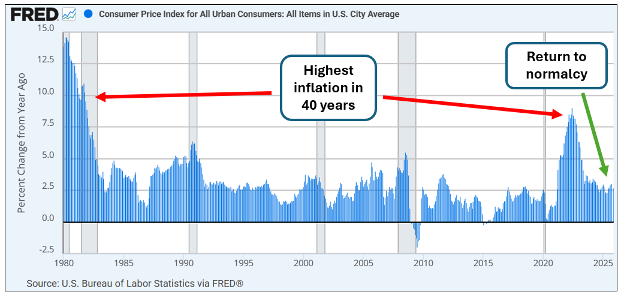

Tailwind – Lower Inflation & Interest Rates

Inflation remained tame during 2025, drifting between 2.3% and 3.0% on an annualized basis. This marks substantial progress since the days of peak inflation in 2022, when prices were increasing at a 9% annualized rate, and has given the Federal Reserve the green light to cut interest rates from levels that restrict the economy (and inflation) to a more neutral position. Their latest projections indicate one cut in 2026 and another in 2027 for an eventual landing at near 3% for their benchmark Federal Funds Rate.

Source: Bureau of Labor Statistics

Lower interest rates reduce the cost of borrowing for individuals and businesses and can stimulate both consumption as well as business profitability. Higher corporate profits usually translate into higher stock prices, which is why we count lower inflation and rates as a clear tailwind for the economy and stocks in 2026.

Headwind – Low Job Creation and a “K-Shaped” Labor Market

Pundits have been referring to the current state of the economy as “K-shaped,” meaing that some groups and demographics are thriving while others are struggling. One space where the “K” is especially pronounced is in the labor market, where unemployment is rising for teens and young adults, but has remained at historic lows for everybody else.

Source: Bureau of Labor Statistics

Why the discrepancy? Some point to skill mismatches while others suggest that AI is replacing entry level talent. Whatever it is, increasing joblessness is not ideal, and while the current 4.4% unemployment rate suggests the labor market is still generally healthy, a continued trend of rising youth unemployment could have a dampening effect on the economy as a whole.

New job creation has also recently been sluggish, and below the estimated rate of 153,000 jobs/month needed to maintain a stable unemployment level. This tells us that even if widespread layoffs are not occurring, continued slack in the labor market may drag on the economy, which is why the state of the labor market may be a headwind to growth in 2026.

Slight Tailwind – A Trump-Aligned Federal Reserve

Donald Trump has been a long-time critic of the Federal Reserve, urging lower rates and monetary stimulus during both of his terms. This is unusual, but not unheard of, as history buffs may recollect Lyndon Johnson’s stunt in 1965 of shoving the then Fed chairman against a wall while demanding lower rates. Thankfully, that has not been repeated, but there has been plenty of name calling and threats to fire different Fed officials during Trump’s tenure. Despite these efforts, however, Trump’s influence on Fed policy thus far has been minimal.

Many are concerned this is about to change as Trump will have the opportunity to appoint a new chairperson to the Federal Reserve in May, and he has already committed to nominating an authority who believes in significantly lower interest rates.

How would a Trump-aligned Fed chair be able to influence policy? For one, they would be allocated one of the 12 votes cast by various Fed officials at each meeting to set interest rates. In other words, the Fed chair cannot steer rate policy on his/her own. What they can do though is use their influence to sway fellow board members as well as public opinion to support different policies. We anticipate that the degree of that influence on policy will only be modest, but this remains to be seen.

If a future Trump-friendly Fed chair can align monetary policy with the executive branch’s current priority (economic stimulus), we could expect higher economic growth but also the potential for higher inflation.

Bottom Line – We Lean Bullish for 2026

Major macroeconomic data and policy paths (i.e. fiscal and monetary stimulus) suggest strong tailwinds for the stocks, bonds, and the economy in 2026. Corporate profits retreated slightly during the first part of 2025 due to tariff turmoil, but record gains appear likely again in 2026. Tax cuts from the One Big Beautiful Bill Act and an accommodative Fed should support a healthy consumer and vibrant business environment as well. All considered, our 2026 forecast is bullish for investment markets, corporate profits, and the US economy.

As always, we are grateful to be your trusted partner in all matters financial and look forward to serving you in the new year.

If you would like to contact us please complete the short form below to request a meeting, or email us at stephen@stephenzelcer.com .